Jürgen Hendrich, CEO and MD of MEO Australia, talks to Jayne Flannery about the importance of creative thinking to build shareholder and environmental value through the exploration and commercialisation of hydrocarbon resources.

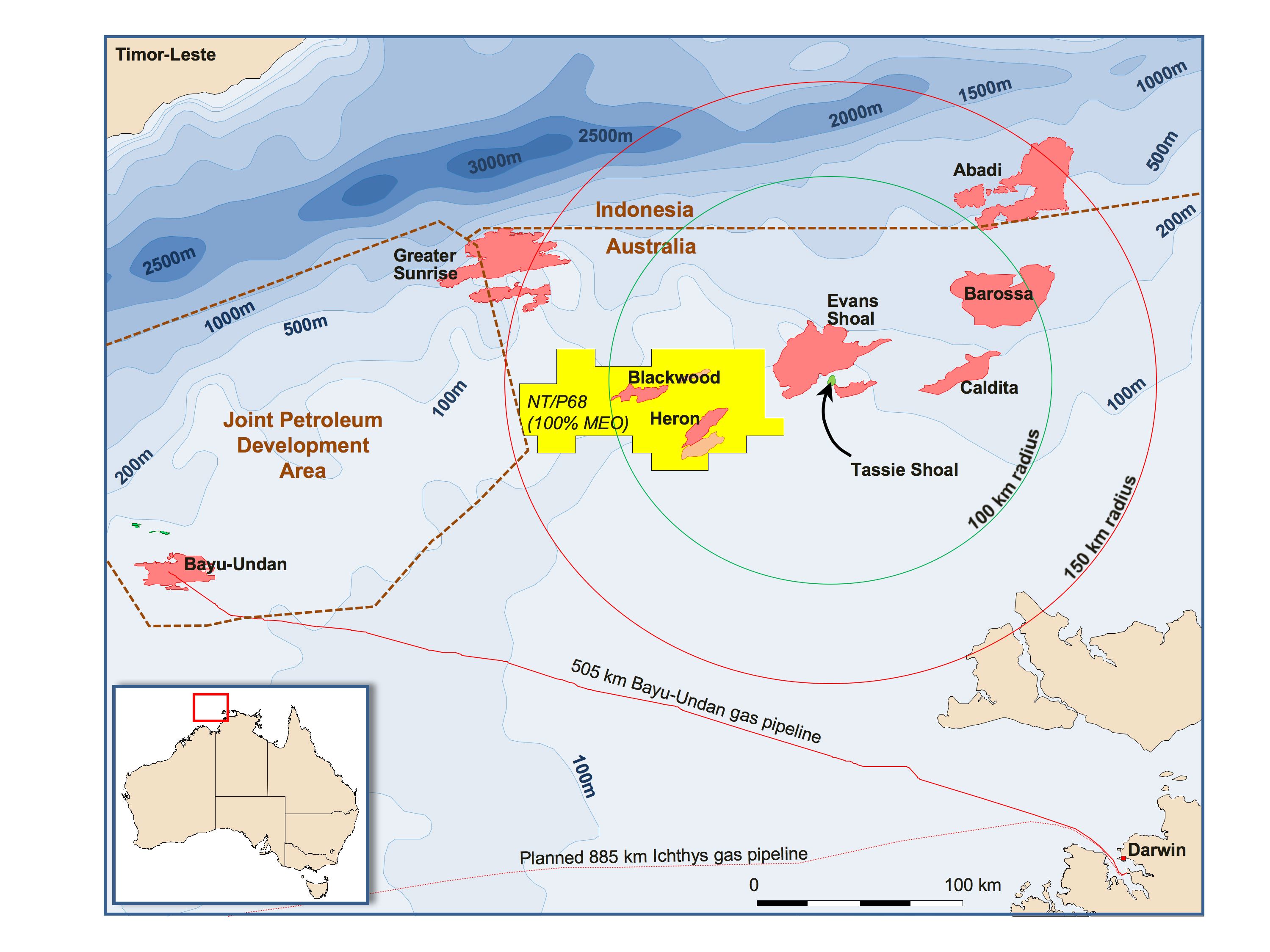

MEO, which is listed on the Australian Stock Exchange, manages a natural gas project portfolio centred in Australia’s premier offshore LNG provinces in the Bonaparte and Carnarvon Basins of the Timor Sea. However, for Jürgen Hendrich, who functions as both CEO and MD of the company, discovery means something much more far-reaching than identifying the physical location of gas deposits.

“Strategically, we search out angles to apply a different perspective to challenge prevailing paradigms. This is what differentiates us: we look for opportunities that others don’t see. As a company, we want a footprint in areas that are neglected, tired or overlooked where we can apply our technical imagination to create value,” he states.

MEO relies on a unique blend of strategic insight and technical expertise supported by the finest geotechnical and commercial talent that Hendrich can identify. “From the outset, we have sought to attract the highest calibre staff. It is the collective, intellectual capability that our staff bring to the organisation which creates a whole that is greater than the sum of its parts. Talented people working in a stimulating environment with aligned motivation enables us to punch well above our headcount or market capitalisation weight,” he explains.

Last year, MEO introduced the world’s third largest listed oil and gas company Petrobras, as a partner. “Petrobras entrusted us to continue to operate the permit on behalf of the new joint venture. This demonstrates our ability to make an impact on the industry,” he adds.

2011 has started on an equally positive note. MEO is finalising a farm-out of part of its 100 per cent owned NT/P68 exploration permit in the Bonaparte Basin, which contains two significant gas discoveries. Hendrich is reluctant to be drawn on details of the deal’s terms, but confirms that MEO will retain 100 per cent ownership of one of the discoveries. “The deal is important to us, because it introduces risk capital to the joint venture to support appraisal drilling operations which will hopefully lead to a commercial development,” he says.

In the same region, MEO has also developed a commercialisation path and secured environmental approvals to install a three mtpa LNG plant (the Timor Sea LNG Project) and two 1.75 mtpa methanol plants (the Tassie Shoal Methanol Project).

“Most of the discovered gas resources in the region are economically stranded, firstly because of the remote location from any potential onshore infrastructure,” he explains. “The second challenge relates to the quality of the gas. Natural gas often contains varying quantities of natural gas liquids, which are a bonus as they generate an additional revenue stream. Many of the stranded gas fields are deficient in natural gas liquids. In addition, natural gas can often contain inert components such as nitrogen or CO2. Where gas is low in liquids it tends to be high in these inert gases. The gas in the region contains variable CO2 which needs to be removed from the processing stream, thereby adding to operating costs,” he continues.

It is easy to see that the economics associated with this sort of venture can quickly become marginal. But innovative thinking at MEO has addressed these two key impediments. “In the project for which we hold approval, we have identified a natural feature on the seabed that in places comes to within 15 metres of mean sea level. We plan to make use of this natural feature to locate the processing infrastructure in the heart of the stranded gas fields and overcome the tyranny of distance.”

The second obstacle is the high CO2content. The Evans Shoal gas discovery contains approximately 28 per cent CO2, which makes it ideal for conversion into methanol. Methanol synthesis using steam methane reforming generates excess hydrogen. Adding around 25 per cent CO2 to the natural gas stream balances the equation and increases the yield of methanol.

Methanol has historically been viewed as a poor cousin in the energy business, but Hendrich believes this is an outdated paradigm. “In China, methanol demand is growing very strongly not only as a traditional chemical feedstock, but increasingly as a fuel blending agent. Methanol plants in China use gas derived from pulverised coal as their feedstock. Methanol has myriad applications including plastics, diesel substitution and as an LPG substitute. It is not as deep a market as LNG yet, but we believe it will grow strongly as pressure mounts on more traditional energy sources.”

From a commercial perspective, Hendrich prefers to hitch the company’s fortunes to a rising star rather than link them inextricably to the mature LNG market, which as a global commodity, is subject to full exposure to global cost competition. “As far as LNG is concerned, the high quality, easily recoverable, liquids rich gas resources close to infrastructure have been cherry-picked. Increasingly, we must look to develop the more economically challenging resources. That means finding ways to break the traditional mould. I believe that monetising higher CO2 gas resources via conversion to methanol represents another potentially attractive economic alternative,” he states.

The company currently has around $100 million in uncommitted cash reserves. Hendrich and the team are actively seeking attractive new projects to add to the portfolio, both in Australia and overseas.

“Ultimately, I would like to see us lauded for making a difference to the energy equation on the planet and to achieve that, we need to demonstrate that we possess the intellectual and technical horsepower to view opportunities and challenges from a different perspective. Ultimately to be relevant as a business, we need to deliver value not only for our shareholders, but for all stakeholders. That means continuing to identify and exploit value gaps if we are to remain relevant and become a partner of choice in project developments,” he concludes.

DOWNLOAD

MEOaustralia_APR11_emea-BRO-S.pdf

MEOaustralia_APR11_emea-BRO-S.pdf